Uome supports accountants by preparing their clients taxes, through the reporting feature on the app. Clients no longer need to populate spreadsheets – making life easier for reconciliation.

Priya's Story

Tax Reconcile Ledger VAT Returns

Priya has taken on a new client that is a small business owner. She recommends Uome for invoicing, payments and recording all financial transactions. Priya can calculate corporation tax and VAT returns using the report output from the Uome app. Priya no longer has to send her client a spreadsheet to populate, as the data is retrievable in Uome.

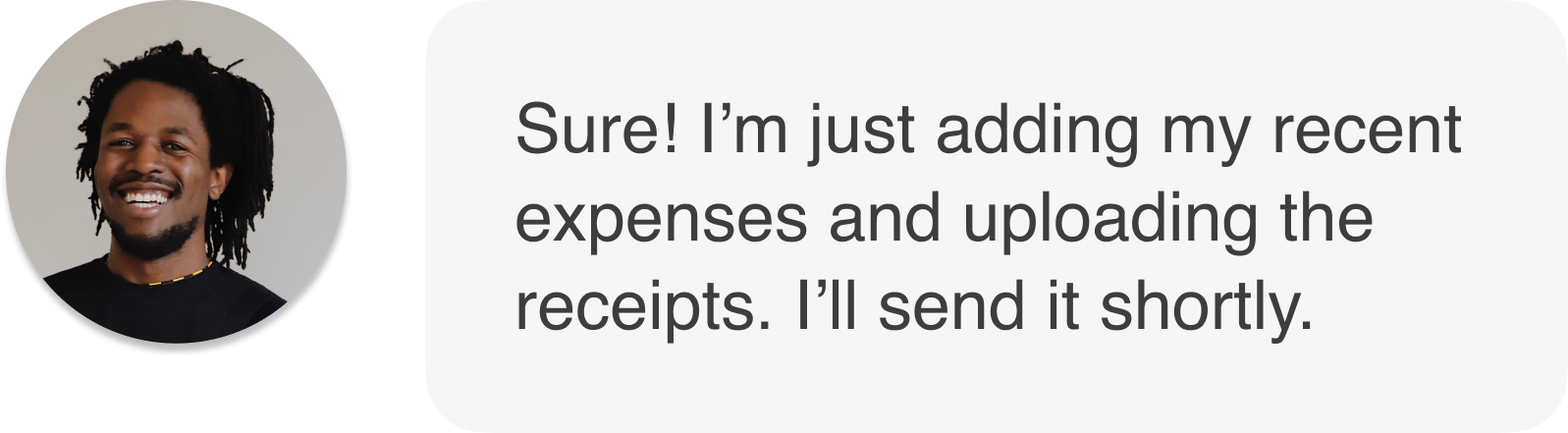

Record expenses

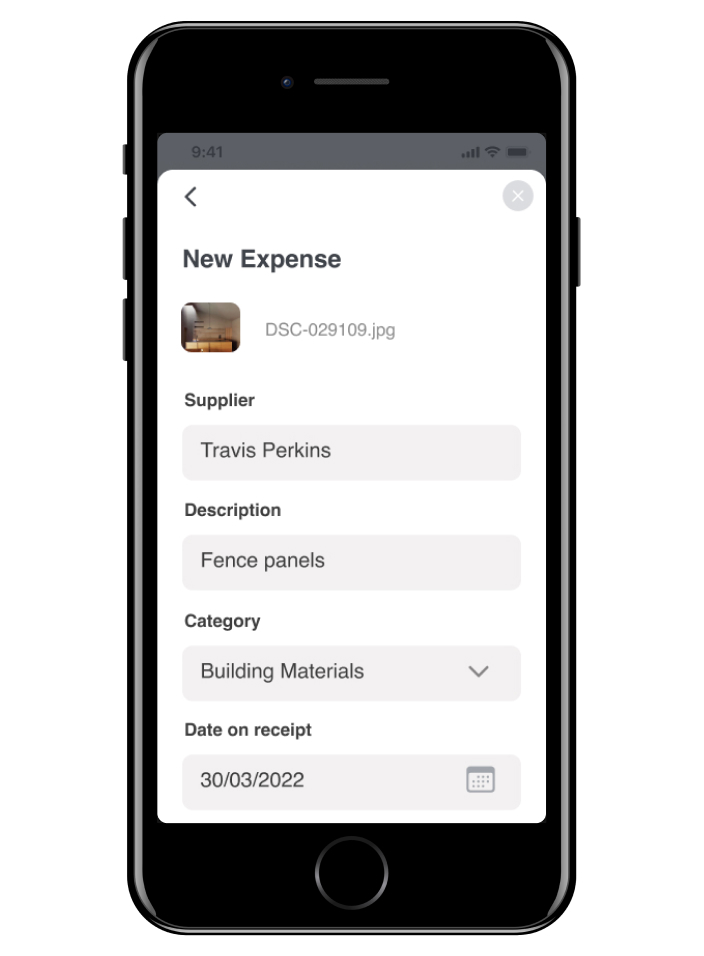

Priya’s clients can record all their expenses through the app and upload receipts. The client can generate a report based on a specific date range and send this to Priya in a PDF or CSV format. Priya uses this data to reconcile the client account and submit returns on their behalf.

Data reports

Priya and her client can keep track of all financial activities using Uome. Reports can be generated to show income, expenses, sales and purchases for each customers’ account. The CSV file can be imported into third-party applications.

Easy bookkeeping

Priya’s manual workload has reduced with Uome. The reporting is clean and easy to use for her and the client – making it easy to sync balance sheets.

”Uome has been a lifesaver for reporting and general ledgers. Everything is well structured and is easy to find. The fact that the data is stored securely online is brilliant. Both me and my clients love it.

PriyaAccountant