In the ever-evolving payments landscape, let’s talk about aPOS a.k.a Application Point of Sale. For many merchants and small businesses, aPOS represents the adoption of digital payments and contactless technology. Something that small businesses must embrace in order to survive in today’s trendy market.

What is aPOS?

aPOS allows you to accept contactless payments using a software app on your smartphone, without the need of additional hardware. We must not confuse aPOS with POS, mPOS, this POS and that POS – solutions which require payment terminals in addition to devices and tablets.

aPOS is a revolutionising force supporting various industries, spanning from vendors and food stalls to delivery services, transportation, and the banking sector.

aPOS against traditional POS systems

Traditional POS systems allow you to accept debit or credit card payments, generate sales and track orders. The terminal also comes with hardware and software components, alongside multiple software for managing your inventory, tracking sales and other customer activities.

With aPOS, you do not need any hardware other than your smartphone. The software app will act like a traditional POS system, accepting payment methods such as credit/debit cards, device wallets, but most importantly – Open Banking! That’s right, say goodbye to waiting for funds to clear; with aPOS, your money flows directly into your account through lightning-fast A2A transfers.

I know what you’re thinking, this is great and how does one get involved with aPOS?

Say hello to Uome, the inventor of aPOS

Uome’s aPOS solution is designed to cater to multiple sectors worldwide, empowering businesses like never before. With Uome, you can gain access to a multitude of payment options, coupled with the essential tools required to streamline your operations and boost your business’s success.

- Open Banking (UK only): Bid farewell to waiting periods. With real-time payments, customers can conveniently transfer funds directly into your bank account through secure A2A transfers.

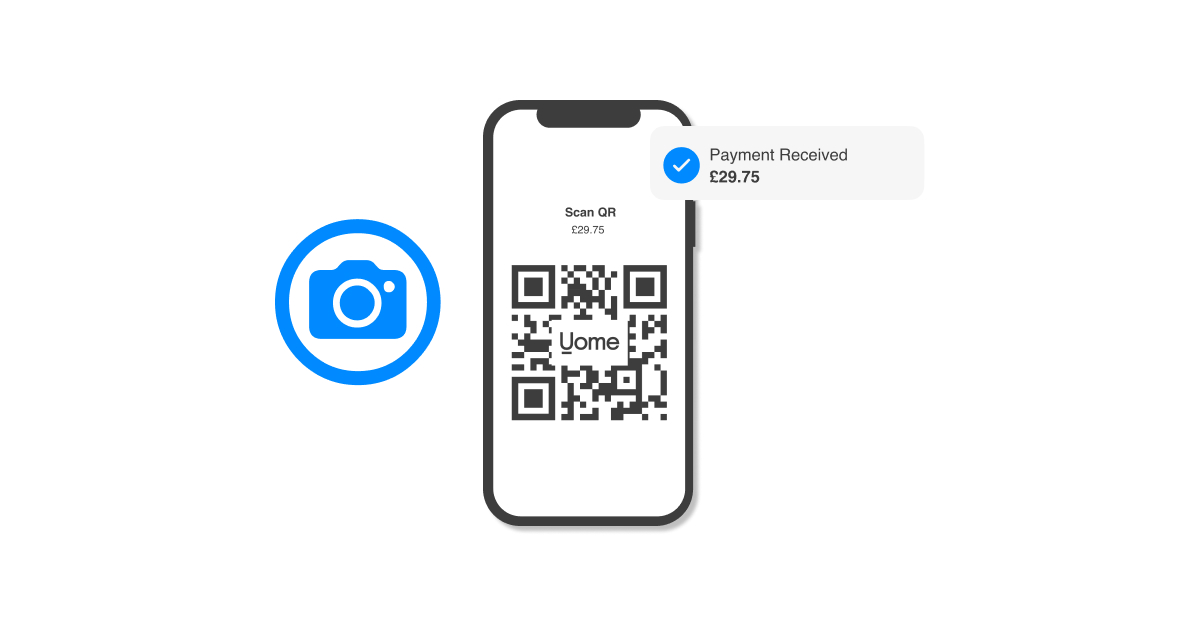

- SMEs: Embrace simplicity and efficiency. Uome’s aPOS requires no additional hardware, allowing your customers to scan and pay effortlessly. Elevate your customer experience and streamline your payment process.

- Gig economy: For on-the-go workers seeking flexible solutions, aPOS is the answer. Leave the burden of carrying extra hardware behind; it’s just you and your smartphone, unlocking a world of opportunities.

- Inventory: Simplify the checkout experience. Add your products to Uome’s intuitive system, allowing ease of selecting items and requesting payments seamlessly.

- Expenses: Take control of your business spending. Track and manage expenses, capture receipts, and generate MTD-friendly reports, ensuring financial clarity and ease of management.

The nitty gritty

aPOS is an innovative technology solution that is poised to reshape the payment sector. By reducing costs and eliminating the need for additional hardware, aPOS emerges as the driving force behind numerous industries. It’s a streamlined and cost-effective alternative that puts you in control.

As a testament to its versatility, Uome’s aPOS solution is available for download on both the Apple App Store and Google Play Store.

Furthermore, Uome offers APIs that allow you to customise and tailor aPOS to your clientele. Visit Uome Developers to find out more.